per capita tax burden by state

State and local tax burden. The five states with the highest tax collections per capita are New York 8957 Connecticut 7220 New Jersey 6709 North Dakota 6630 and Massachusetts.

Which States Pay The Most Federal Taxes Moneyrates

North Dakota ranks first with 7438 per capita and Alaska is second-highest with per capita collections of 7005.

. 51 rows State Total Tax Burden Property Tax Burden Individual Income Tax Burden Total Sales Excise Tax Burden 1. State-Local Tax Burdens by State with Detailed Breakdown Calendar Year 2022. The article cited 2009 Census data the latest available on taxes collected by state and local governments.

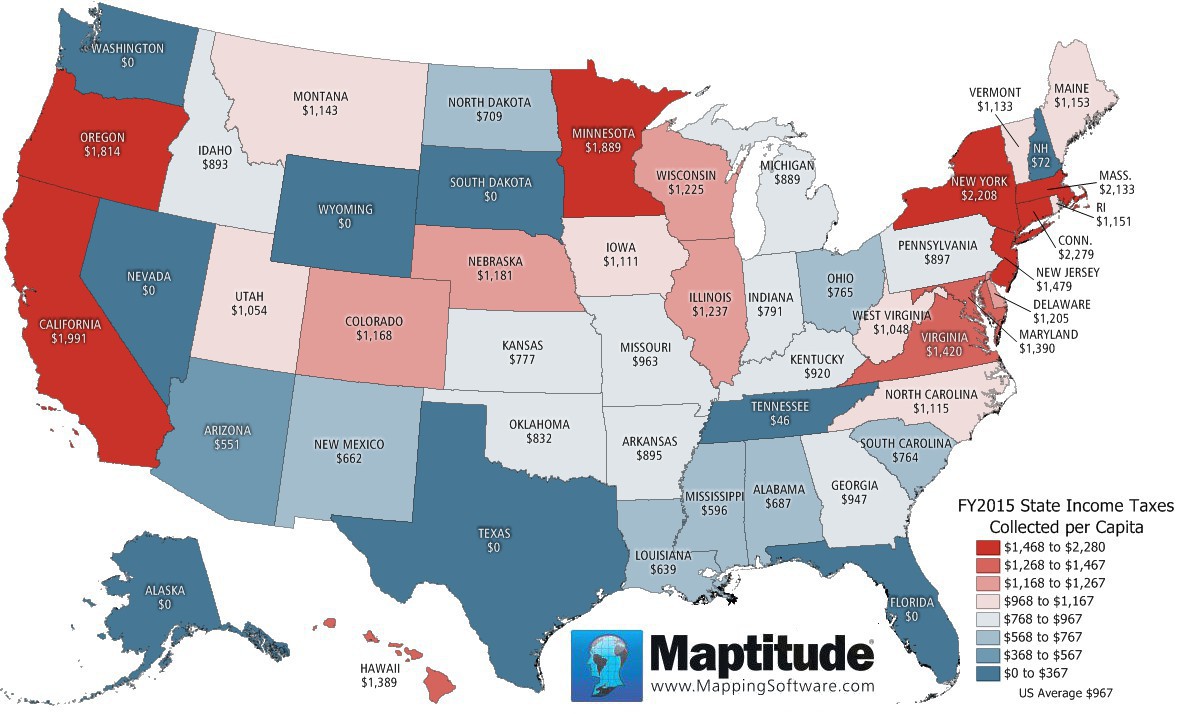

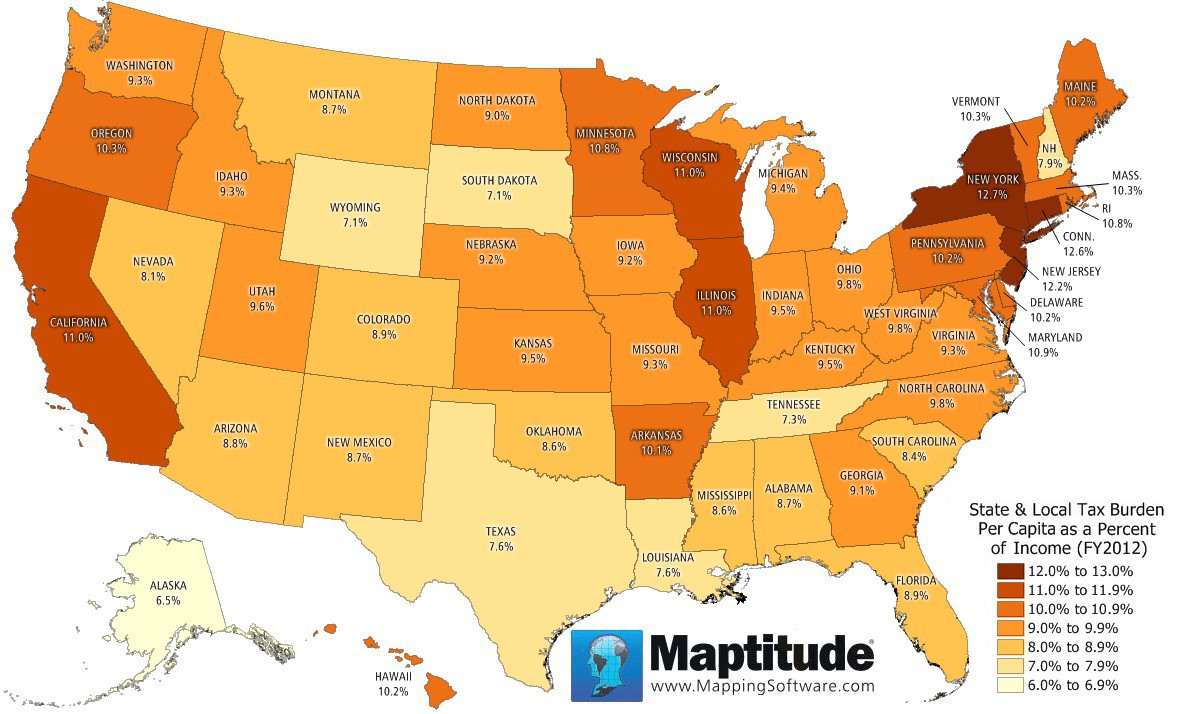

Both data points are calculated with 2016 tax data from the Tax Foundation a nonpartisan think tank in Washington DC. State and Local Issues. Income tax collections per capita.

The statistic above provides information on the state and local tax burden per capita in the United States in fiscal year 2011. Both data points are calculated with 2016 tax data from the Tax Foundation a nonpartisan think tank in Washington DC. 443 6 490 1.

However residents of each of the top 10 states pay 3-5 times as much in federal taxes as residents of Mississippi. 211 rows Total taxes thousands Population Per capita State Alabama. The lowest state and local sales tax collections per capita are found in Alaska 335 Vermont 660 Virginia 651 West Virginia 753 Maryland 781 and South Carolina.

Of course the recent changes to the federal tax law mean some people who live in these states are getting doubly gouged. Rate at highest tax bracket. The average resident of a blue state pays 9438 in federal.

Finally New York Illinois and Connecticut are the states with the highest tax burden for the middle 60 by family income. The effective tax burdens in these states are 125. The five states with the highest tax collections per capita are New York 9829 Connecticut 8494 North Dakota 7611 New Jersey 7423 and Hawaii 7332.

Both data points are calculated with 2016 tax data from the Tax Foundation a nonpartisan think tank in Washington DC. And as the article said if you divide. Rankings of State and Local Per Capita General Revenue.

For Vermont the total was 29 billion. Tennessee 36 and New Hampshire 78 taxed investment income but not wage income making them the states with the lowest individual income tax collections per capita. You can find the rest of the list here.

State and Local Tax Revenue Per Capita. Effective state tax rate 50000 taxable income. State and Local Issues.

State and local tax.

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

States With The Highest And Lowest Property Taxes Property Tax Tax States

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Maptitude Map Per Capita State Income Taxes

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Income Tax Tax Return

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

These States Have The Highest And Lowest Tax Burdens

Property Tax Definition Property Taxes Explained Taxedu

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Which States Are Givers And Which Are Takers The Atlantic

State Tax Maps How Does Your State Rank Tax Foundation

State By State Guide To Taxes Gas Tax Healthcare Costs Better Healthcare

Maptitude Map State Income Tax Burden

The Worst U S States To Retire In Ranked Finance 101 Gas Tax Healthcare Costs Better Healthcare

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax District Of Columbia